Filing SEC Forms 3, 4, and 5 can be a complex and time-consuming process, especially for public companies, insiders, law firms, and filing agents. The intricate requirements, tight deadlines, and potential for costly errors make automation a valuable tool in the filing process. In this article, we explore how platforms like Form345.com simplify SEC filings, focusing on automation, ease of use, and advanced reporting features to meet the needs of the legal and financial sectors.

Understanding SEC Forms 3, 4, and 5

To appreciate the benefits of automation, it’s essential to understand the purpose of these forms:

Form 3: Filed when an individual becomes an insider of a publicly traded company (e.g., a director, officer, or beneficial owner of more than 10% of a company’s equity securities).

Form 4: Filed to disclose changes in the ownership of a company’s securities by an insider.

Form 5: An annual summary of changes not reported on Form 4, often filed at the end of the fiscal year.

Each form serves a distinct purpose but shares the common goal of maintaining transparency and compliance with SEC regulations.

Challenges in SEC Filing

Manual filing of SEC Forms presents several challenges:

Strict Deadlines: Late submissions can result in penalties and damage a company’s reputation.

Complex Requirements: The rules governing these forms are intricate, requiring detailed knowledge of SEC regulations.

Risk of Errors: Manual data entry increases the likelihood of mistakes, which can lead to non-compliance.

Resource Intensive: Managing filings manually consumes time and resources that could be better spent on strategic tasks.

Benefits of Automation for SEC Filings

Platforms like Form345.com address these challenges by offering automated solutions tailored to SEC filings. Here’s how automation makes a difference:

1. Streamlined Data Entry

Automation eliminates the need for manual data entry by integrating with existing systems to pull accurate information. This reduces errors and ensures compliance with SEC requirements.

2. Error Detection and Validation

Advanced software includes built-in validation tools that detect potential errors before submission, saving time and preventing costly mistakes.

3. Time Efficiency

Automation significantly reduces the time required to prepare and file forms. With pre-filled templates and intuitive workflows, users can complete filings in minutes.

4. Compliance Assurance

Platforms like Form345.com stay up-to-date with the latest SEC regulations, ensuring that filings are always compliant. This feature is especially valuable for law firms and financial professionals.

5. Advanced Reporting

Automated systems provide detailed reporting and tracking features, allowing users to monitor filing status and generate comprehensive compliance reports for audits and internal reviews.

6. User-Friendly Interfaces

Modern filing platforms are designed with ease of use in mind, making them accessible even to those with limited technical expertise. Intuitive dashboards guide users through each step of the process.

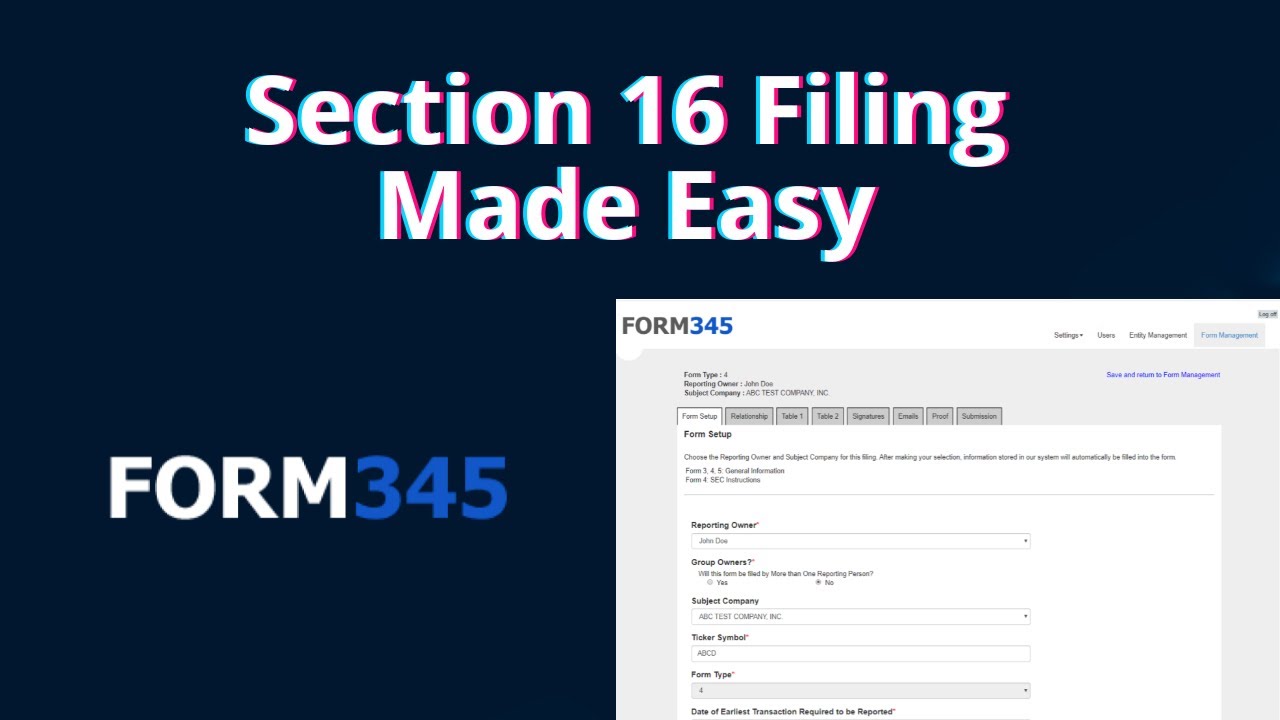

Key Features of Form345.com

Form345.com stands out as a premier SEC filing platform due to its comprehensive features:

Customizable Templates: Save time by using templates tailored to specific filing needs.

Automated Alerts: Receive notifications for upcoming deadlines to ensure timely submissions.

Bulk Filing Support: Manage multiple filings simultaneously, a critical feature for filing agents and large corporations.

Secure Data Handling: Advanced encryption ensures the safety of sensitive information.

Collaboration Tools: Facilitate teamwork by allowing multiple users to collaborate on filings in real time.

Why Legal and Financial Professionals Should Embrace Automation

For law firms and financial professionals, the stakes in SEC compliance are high. Automation offers a competitive edge by:

Enhancing Productivity: Focus on strategic initiatives rather than administrative tasks.

Reducing Costs: Minimize the need for manual oversight and correction of errors.

Improving Accuracy: Ensure precise and compliant filings every time.

Boosting Client Confidence: Demonstrate professionalism and reliability with timely and error-free submissions.

Getting Started with SEC Filing Automation

Transitioning to automated filing is easier than ever with platforms like Form345.com. Here’s how to get started:

Evaluate Your Needs: Assess the volume of filings and specific requirements of your organization.

Choose the Right Platform: Select a solution that offers the features and scalability your business requires.

Onboard Your Team: Provide training to ensure all users are comfortable with the new system.

Monitor and Optimize: Use reporting tools to track performance and make improvements as needed.

Conclusion

Automation is transforming the way public companies, law firms, and filing agents handle SEC Forms 3, 4, and 5. Platforms like Form345.com offer user-friendly, efficient, and compliant solutions to simplify the filing process. By embracing these tools, legal and financial professionals can save time, reduce errors, and focus on delivering greater value to their clients.